Copper: The Situation in the USA in July 2025

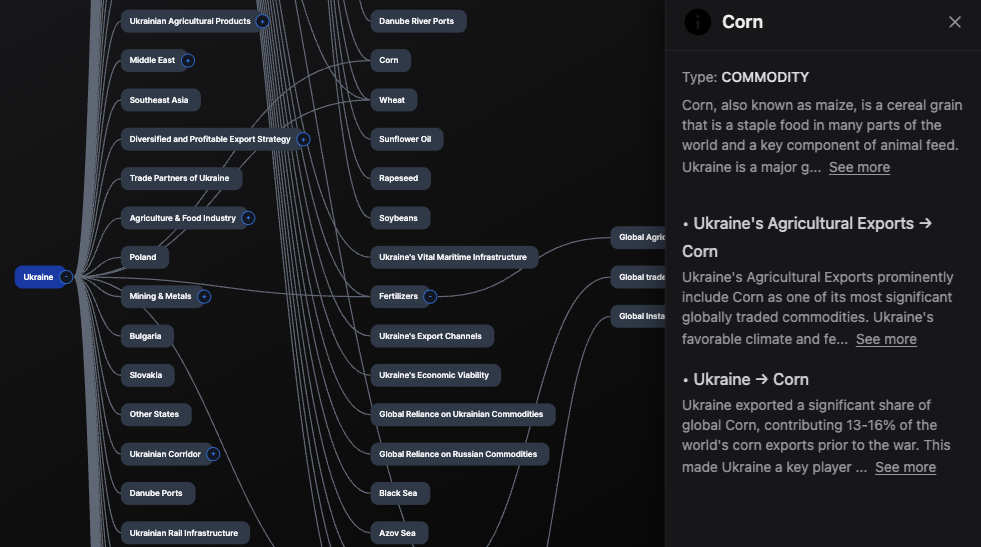

Relationship graph generated by Datafalk Engine on stakeholders from the article

Introduction

This chapter examines the situation of the United States regarding its copper supply in July 2025. Three key dynamics emerge:

- a persistent dependence on foreign refined copper,

- largely insufficient domestic processing capacity,

- a political strategy refocused on self-sufficiency through tariff measures.

Together, these reveal a strategic vulnerability in the context of a global energy transition and growing geoeconomic competition.

1. Context & Issues

Copper is an essential industrial metal for modern infrastructure, the energy transition, and digital technologies. In 2024, global copper consumption reached 27 million tons and is expected to reach 33 million in 2035, then 37 million in 20501. This growth is mainly driven by electric vehicles, renewable energy, and data centers. An electric vehicle contains three to four times more copper than a combustion vehicle, and modern power grids require large volumes of this metal1.

The United States, while being the fifth largest producer in the world, had a net dependence on copper imports estimated at 45% in 20242. This dependence has worsened over the past decade, with imports multiplying sixfold since 2014, while domestic production fell by 20%3. Yet, the country has abundant mineral reserves and a significant mining industrial base. This paradox is explained by a chronic deficit in smelting and refining capacity. In 2025, only two primary smelters are operating on American soil2.

President Trump's decision, announced on July 9, 2025, to impose a 50% tariff on copper imports starting August 1, marks a turning point in American industrial policy. This measure aims to reduce foreign dependence, strengthen domestic production, and restore economic sovereignty. It is part of a broader strategy to secure critical supply chains, initiated at the start of his second term.

2. Detailed Analysis

The United States imports the majority of its refined copper from Latin America, mainly from Chile (65%), Canada (17%), and Mexico (9%)2. In 2024, the country consumed 1.6 million tons of refined copper, compared to a domestic production of only 890,000 tons2. The gap is filled by imports of copper processed abroad, including from ore extracted in the United States. This phenomenon, known as "circular trade," forces the country to ship its copper concentrates abroad for processing, before re-importing them4.

This model presents three types of costs: economic, environmental, and strategic. Economically, processing abroad represents an estimated loss of between $200 and $300 million per year4. Environmentally, it generates an additional 500,000 tons of CO2 annually4. Strategically, it exposes the American supply chain to major geopolitical and logistical risks.

Mining production, concentrated in Arizona (70% of the total), declined by 3% in 20242. This drop is explained by lower ore grades and operational restrictions. At the same time, major expansion projects like Resolution Copper remain blocked by regulatory delays or land disputes with indigenous communities5. The development of new mines in the United States often takes more than ten years, and investments in modern metallurgical facilities reach $2 to $4 billion per site4.

The restart of certain capacities (Kennecott in Utah) and new secondary refinery projects are not enough to compensate for the shortcomings of the current system. The low processing capacity prevents the efficient exploitation of domestic resources, especially in the face of a general decline in ore grades, which requires more processing for constant volumes of refined copper2.

The announcement of the 50% tariff on imports triggered a series of immediate reactions in the markets. Futures prices reached a record $5.95/lb, before falling back below $5.50 by mid-July, reflecting massive stockpiling and anticipation of price increases56. The ports of Houston, Newark, and Los Angeles saw a surge in imported cargoes, indicating that buyers are seeking to secure their supplies before the tariff takes effect7.

This dynamic creates a "storage paradox": the tariff, intended to encourage domestic production, causes an excessive accumulation of imported stocks, leading to price distortions and market instability. In the long term, this mechanism could penalize American manufacturers, who will face a lasting increase in input prices without necessarily benefiting from sufficient domestic supply. The price differential between COMEX and LME exceeded 25%, creating a desynchronization of reference markets5.

Meanwhile, China continues to dominate the entire copper value chain. In 2024, it accounted for more than 45% of global refined copper, six times Chile's production7. It consumes nearly 60% of global refined copper and imported 60% of the ore and concentrates available on the markets8. Investments under the BRI ($24.9 billion in H1 2025) demonstrate a continued expansion strategy, notably in resource-rich countries like Kazakhstan9.

Although US tariffs aim to strengthen the domestic industry, they could actually benefit China. By artificially reducing US demand on global markets, they allow China to acquire copper at lower prices10. The risk is therefore twofold: a loss of competitiveness for American manufacturers and an indirect strengthening of Chinese leadership.

Recycling plays a significant role in national supply (35% of copper in 2024), but its growth prospects are limited2. The average lifespan of copper in equipment (about 20 years) slows the rapid recovery of significant volumes1. Nevertheless, recycling remains a strategic component, notably through urban mining efforts and targeted acquisitions (e.g., Metallix by Sibanye-Stillwater)11.

Finally, several public initiatives seek to correct current imbalances. The 48C program provides $10 billion in tax credits for projects related to critical materials12. The Department of Energy (DOE) manages a program dedicated to strategic materials with $425 million in targeted grants13. The "Critical Mineral Consistency Act" bill aims to harmonize copper's status as a recognized strategic mineral14. Despite these efforts, achieving complete self-sufficiency remains unlikely in the medium term.

3. Synthesis & Recommendations

The United States faces a structural imbalance between its copper extraction capacity and its ability to process it locally. This vulnerability is exacerbated by excessive dependence on refined copper imports and an inability to develop sufficient metallurgical infrastructure. The current tariff strategy aims for rapid industrial relocation but risks aggravating trade tensions and creating lasting market distortions.

The analysis suggests that only integrated measures, simultaneously addressing mining, industrial, environmental, and diplomatic issues, will enable the construction of a resilient and competitive national supply chain.

Cited Sources

Footnotes

-

https://carboncredits.com/copper-demand-set-to-hit-37m-tonnes-by-2050-can-supply-keep-up/ ↩ ↩2 ↩3

-

https://pubs.usgs.gov/periodicals/mcs2025/mcs2025-copper.pdf ↩ ↩2 ↩3 ↩4 ↩5 ↩6 ↩7

-

https://discoveryalert.com.au/news/proposed-us-copper-tariffs-2025/ ↩

-

https://discoveryalert.com.au/news/americas-copper-supply-chain-imbalance-2025/ ↩ ↩2 ↩3 ↩4

-

https://discoveryalert.com.au/news/us-copper-supply-chain-2025-imports/ ↩ ↩2 ↩3

-

https://carboncredits.com/rio-tinto-antofagasta-lead-copper-surge-but-trumps-tariff-threat-casts-a-shadow/ ↩

-

https://www.cato.org/blog/copper-tariffs-are-new-steel-tariffs ↩ ↩2

-

https://unctad.org/publication/global-trade-update-may-2025-critical-minerals-copper ↩

-

https://blogs.griffith.edu.au/asiainsights/china-belt-and-road-initiative-bri-investment-report-2025/ ↩

-

https://aier.org/article/why-trumps-copper-tariffs-will-hurt-us-industry-and-help-china/ ↩

-

https://www.resource-capital.ch/en/news/view/sibanye-stillwater-to-acquire-us-metals-recycler-metallix-enhancing-its-global-recycling-footprint/ ↩

-

https://www.energy.gov/infrastructure/qualifying-advanced-energy-project-credit-48c-program ↩

-

https://www.energy.gov/cmm/critical-minerals-and-materials-program ↩

-

https://source.benchmarkminerals.com/article/critical-mineral-consistency-act-targets-copper-status-upgrade ↩

Enjoyed this article?

Subscribe to get the latest insights from Datafalk delivered to your inbox.

Datafalk Blog

Get the latest insights from Datafalk delivered to your inbox.

Related Posts

CO₂: Achilles' Heel and Strategic Lever of the French Food Industry

Terres rares : la nouvelle vulnérabilité stratégique de l’industrie automobile mondiale